The tips here are designed to help you find the correct homeowner’s insurance plan for your needs.

Paying off your mortgage will lower your insurance costs. Paying off a mortgage takes time, but it’s worth it in reduced costs. They expect that you’ll be more motivated to take better care of your house if it’s all yours.

It’s important to know how you’ll be covered if your home after it’s damaged or being rebuilt.Some insurance policies cover expenses incurred if something happens to your home.You need to be careful and save all your receipts to show for proof.

Keep a detailed inventory of all valuable items within your home to process claims quicker. It is extremely difficult to recall your home whenever a disaster has occurred. The most simple way is photographing everything is to open your closets and snap a few photos.

As the size of your family and personal possessions change, make sure you re-evaluate your homeowner’s insurance needs as well. You need a second look to see if coverage limits exist on valuable items exist. If you have specific items you want covered, you can ask for a separate rider to cover those against theft.

Flood insurance is a house.

Flood insurance may not be at the forefront of your mind when it comes to insuring your home, but it could be a good idea anyway.You might also get insurance should you live in is low or medium risk.

If you share a home with roommates, check your homeowner’s policy to find out what the coverage is in case of a disaster. Some policies cover everything, but others cover the contents. Make sure you know exactly what is included in the policy.

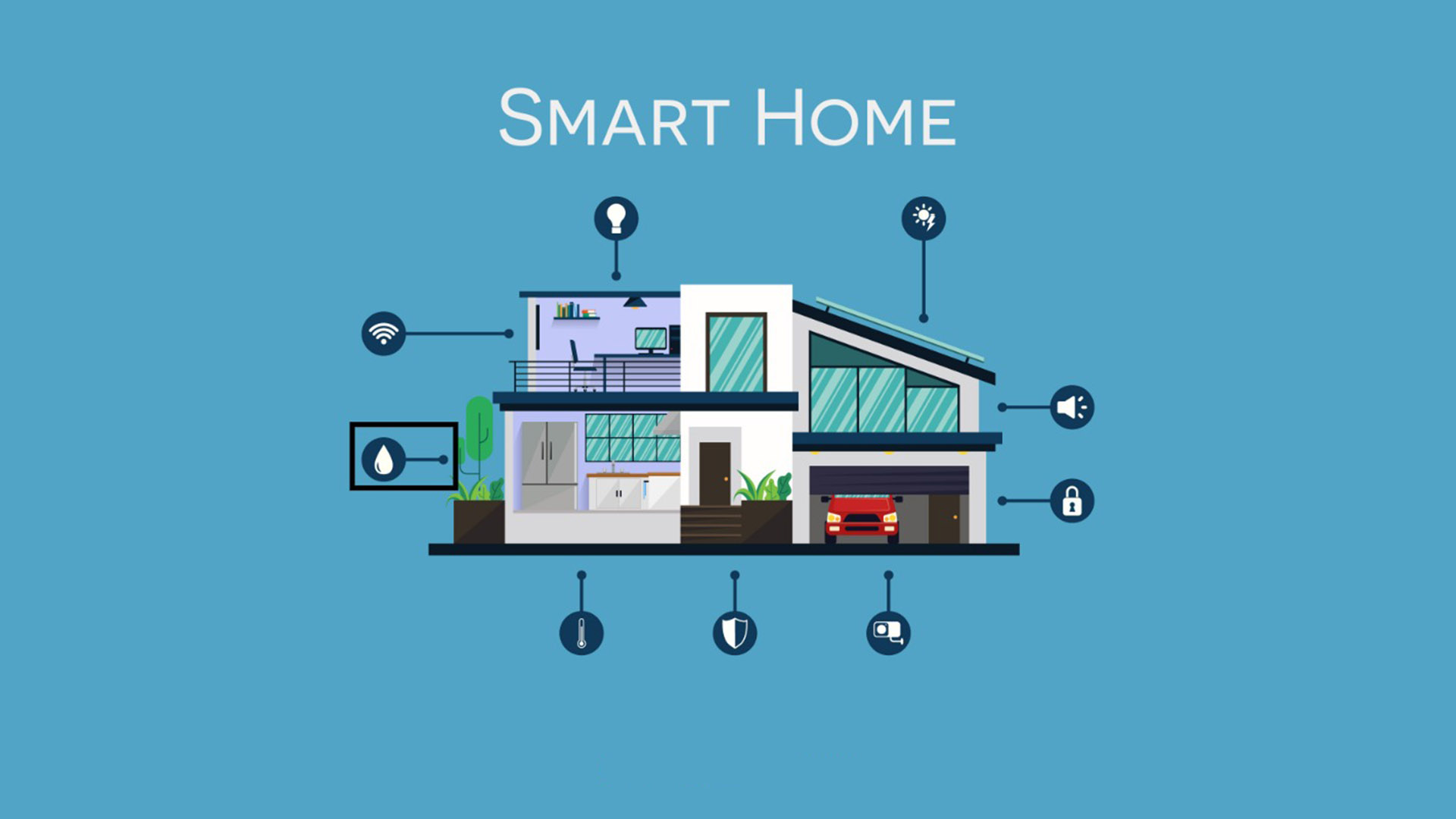

Safety is key when it comes to insurance. Smoke detectors, fire extinguishers and burglar alarms can provide you additional discounts on your insurance.Not only will these things save you money, it can save your life.

You can save lots of money on insurance amounts by having a home security system. The more you are doing to protect your home, you become less risky to the insurance company, lowering your premium significantly. Your savings on insurance premiums will help pay for your security system.

You can lower your annual insurance each year by installing more fire alarms. Insurance companies are plenty of fire detection devices on hand. Some companies may reduce your premium even bigger discount when homes have many fire alarms.

Pay off your entire mortgage and enjoy reduced insurance premiums. This will help you save a bundle on your premium rates by substantial amounts. A home that is owned appears to be more cared for than one which is under mortgage to insurers.

These tips are a great way to learn about the different types of policies for you. There are plenty of tips from this site which can get you on track. Apply these simple techniques to get the perfect policy for your needs.